Studer Community Institute Reports

The Studer Community Institute publishes reports focused on education and early learning. Read past reports via the links below or view downloadable PDFs.

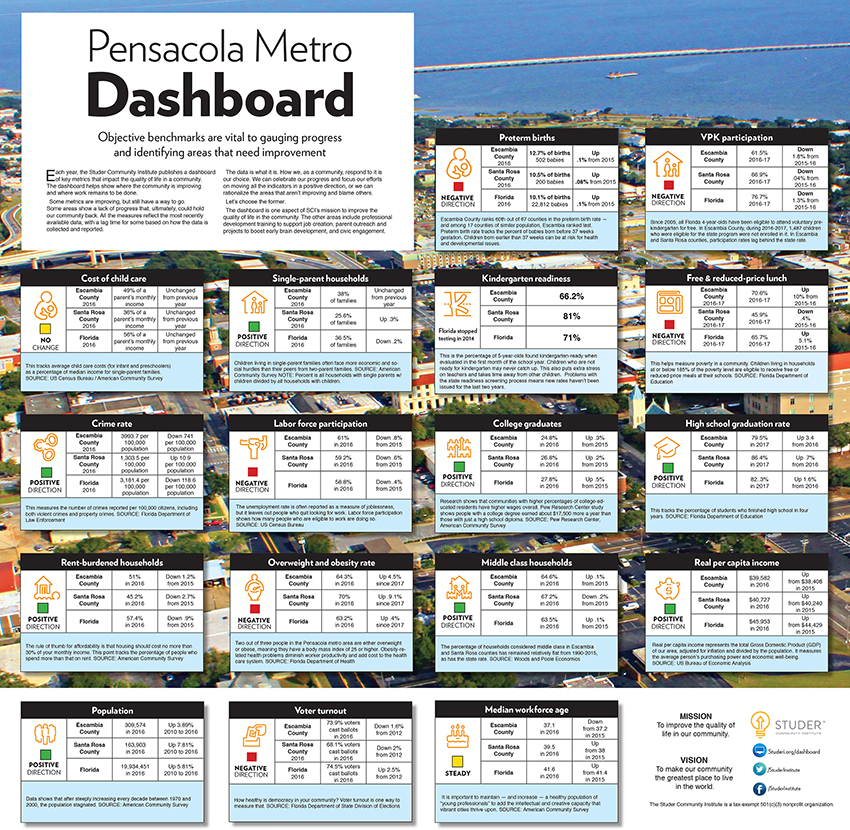

Pensacola Metro Dashboard

SCI developed the dashboard in consultation with the University of West Florida, whose researchers helped us settle on 16 metrics that gauge the economic, educational and social well-being of the community.

TMW Tips: How To Build A Baby’s Brain

The tips offer practical advice for parents and caregivers to exposure young children to more words.

Meeting the Challenge

A visit to each of Escambia County's 11 low-graded elementary schools reveals challenges, hopes.

Quality From 0 to 5

As we learned, there are challenges in determining "quality," but recognizing and rewarding it — and making sure it is accessible — is something local officials are focusing on.

Early Education Report

As attention has focused more on kindergarten readiness, changes in testing procedures have left Florida's voluntary prekindergarten program struggling to answer what it means to be ready for school.

Pockets of Poverty

If an image is worth 1,000 words, the image below isn’t kind to Escambia County.

Progress Starts Here

At the county-by-county level, data from the Studer Community Institute Pensacola Metro Dashboard shows Santa Rosa facing growing pains and Escambia dealing with the impact of poverty on the community as a whole.

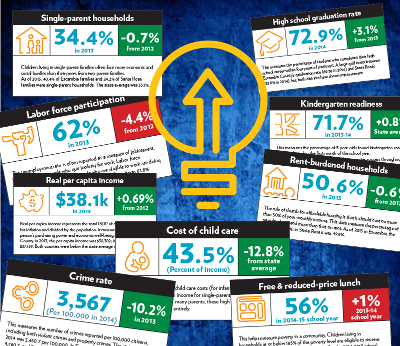

Dashboard 2015 What gets measured gets improved

The Studer Community Institute’s Pensacola Metro Dashboard update for 2015 shows progress in many areas — and work still to do to improve the quality of life in the community.

Pensacola Education Report 2015, Part 3

The third installment of the Institute's 2015 education report looks at the growing body of research that supports the importance of early learning.

Pensacola Education Report 2015, Part 2

It can be done! The second part of the Pensacola Education Report looks at bright spots in education.

Pensacola Education Report 2015, Part 1

Springtime in Florida means one thing — FCAT. But this year, the test used to measure students’ learning gains and to evaluate teacher performance is not what it used to be.

Pensacola Metro Report 2014

The Institute’s staff spent five months researching the material that would become the first Pensacola Metro Report.

Early Learning Overview

In working with many local and state resources and experts, as well as utilizing resources from the University of Chicago, a leader in early brain development, the steps have been identified that will help every child be ready for kindergarten.

Complete Early Learning City Roadmap

Creating America’s First Early Learning City is the largest and most important construction project in the history of Escambia County

Updates on the 3Ts-Newborn implementation trial

A two-year research project shows video lesson can be a powerful tool to teach mothers.

Basics Insights Text Messaging: Overview and Estimated Impacts on Parenting of Children Aged Birth to 3

Analysis of the pilot group shows texting platform can nudge parents to do more brain-building basics.

Join Our Newsletter